colorado solar tax credit 2022

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. Discover Solar Power Pros In Your Area.

The U S Solar Industry Needs Certainty Our Letter To The Biden Administration Vote Solar

Colorado solar tax credit 2022 Thursday July 7 2022 Edit.

. Ad Over 45000 PV Designs Are Created Weekly Using Aurora Solar Software. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC. So if you buy install and use the solar panels within 2022 you may qualify for the 26 credit.

Take Advantage Of This Offer And More In Seconds. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. You may use the Departments free e-file service Revenue Online to file your state income tax.

In addition to incentives that may be available from the city. So for example if you pay 20000 for your. The solar investment tax credit ITC which was scheduled to drop from 26 to 22 in 2021 will stay at 26 for two more years.

On top of that if youre a customer of Black Hills Energy Xcel Energy or other local utilities you could earn bill credits for the excess solar energy you produce through their net energy. Ad Check Your Eligibility For Savings Like 0 Down And The 26 Tax Credit For Homeowners. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate.

However you may only be eligible for a 22 tax credit if you do that. Congress has extended the credit multiple times but it is currently set to expire soon. The federal tax credit for home solar projects will dip to 22 in 2023 meaning its best to install solar as soon as possible to take full advantage.

That means it needs to start producing electricity for you before you apply for the tax credit. You do not need to login to Revenue Online to File. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

To maximize your ITC. But cash in on the 26 percent credit soon since it is valid only till. State All of Colorado can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation costs for an unlimited amount.

Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Right now in 2022 the tax credit for new residential and commercial solar installations is 26 of the cost. While the commercial ITC will.

Leigh Matthews BA Hons HDip. Learn About Solar Power Today. Get Solar Power Price Quotes Today.

Easily Create Advanced Solar PV System Designs In Minutes From Your Computer. The average cost of a solar panel system ranges between 15000 and 25000. The federal tax credit falls to 22 at the end of 2022.

Ad A Comparison List Of Top Solar Power Companies Side By Side. Ad Find Solar Power Prices By Zip. And if you install solar in Colorado before the end of 2022 dont forget your 26 federal solar tax credit.

So when youre deciding on whether or not to. Read User Reviews See Our 1 Pick. NT Leigh Matthews BA Hons HDip.

So as long as you install your solar panels prior to December 31 2022 youll enjoy a 26 tax credit when you file your federal taxes. Customers of Fort Collins Utilities who install a solar photovoltaic system may be eligible for a rebate of up to 1500. This ITC will not last forever.

State tax expenditures include individual and corporate income tax credits. Find The Best Option. This memorandum provides information on state tax expenditures for renewable energy resources.

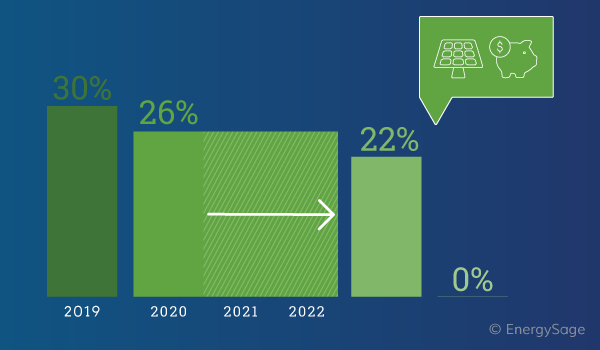

It holds steady at 30 through 2019 after which there is a gradual decrease until the credit ultimately reaches a cap at 10 in 2022. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. The Solar ITC can help to significantly reduce the total cost of a home solar system.

For instance if you purchase solar panels worth 15000 you can get a credit of 3900 on your federal taxes. Save time and file online. This means that all solar projects that begin.

Using this a taxpayer can claim 26 percent of the cost of a solar. 2022s Top Solar Power Companies. Enter Your Zip See If You Qualify.

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

Everything You Need To Know About Operations Maintenance O M For Utility Scale Pv Solar Plants Solar Installation Solar Panels Solar Companies

2016 United States Solar Power Rankings Solar Power Rocks Solar Energy Facts Solar Power Solar Power House

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

Why Solar Power Actually Pays Off Even In Regions With Cheap Electricity Cnet

Up To 90 Off On Solar Panel Installation At Find My Solar In 2022 House Design Modern House Solar House

Why Solar Power Actually Pays Off Even In Regions With Cheap Electricity Cnet

Solar Tax Credit 2021 Extension What You Need To Know Energysage

2018 Guide To Virginia Home Solar Incentives Rebates And Tax Credits Solar Panels For Home Solar Energy Panels Solar Power

Pricing Incentives Guide To Solar Panels In Colorado 2022 Forbes Home